The analysis of television viewing trends highlights the profound impact of streaming services on traditional TV consumption. According to Ofcom’s data, the main Public Service Broadcasting (PSB) channels in the UK have experienced a significant decline in their market share, from 100% in 1988 to approximately 51% in 2017. A parallel trend is evident in the United States, where network and cable television have ceded substantial ground to streaming platforms (Ofcom, 2018).

Additionally, figures illustrate a sharp reduction in time spent with physical print media and music consumption via traditional formats, with digital alternatives such as online news platforms and music streaming services gaining dominance. A key observation is the shift in daily television viewing patterns, with total screen time remaining relatively stable from 2014 to 2017 but decreasing to 4 hours and 28 minutes per day by 2022 (Ofcom, 2022). The younger demographic (16–34 years old) has particularly accelerated this shift, spending up to 85% more time on non-broadcast content compared to older age groups, with platforms like YouTube emerging as primary sources of entertainment (Nielsen, 2023).

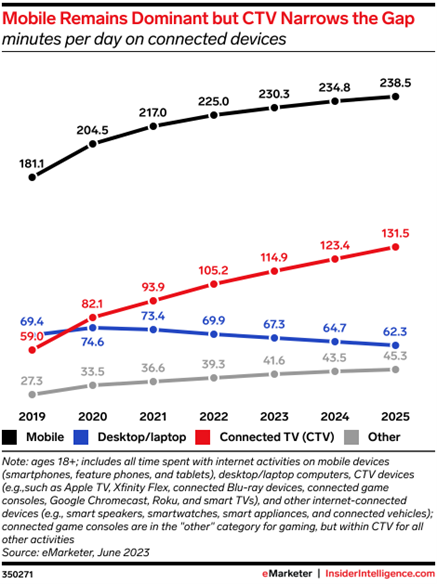

Another notable development is the rise of Connected TV (CTV) viewing, where traditional television is now competing with digital content. Data from 2017 onward show that non-broadcast content on CTV devices has steadily increased, with YouTube alone accounting for 11.1% of all television viewing in the US (Nielsen, 2023). The monetization of digital content has also expanded, with YouTube’s partner program distributing over $30 billion to content creators over the past three years (YouTube, 2024).

The financial impact on the TV production sector is also evident. UK production companies’ revenues grew from £6.7 billion in 2021 to a projected £8 billion by 2030. However, the recent market downturn resulted in a £392 million decline in total revenues in 2023, coupled with a 10% reduction in commissioning spending (Ofcom, 2023; Pact, 2024).

Developments

The findings suggest that television has undergone a significant transformation due to the advent of digital streaming. Traditional broadcasters are facing competition not only from subscription-based streaming services (SVODs) but also from ad-supported platforms (AVODs) and user-generated content. The decline of PSB channels, particularly among younger audiences, highlights the urgency for adaptation.

CTV has played a pivotal role in reshaping audience behavior, with increasing time spent on platforms like YouTube and other digital services. The convergence of TV and digital content has blurred the lines between professionally produced and creator-generated content. Furthermore, revenue challenges persist as traditional models struggle to replace the profitability of conventional television broadcasting.

The Future

The television industry stands at a crossroads, requiring strategic adaptation to survive in an evolving digital landscape. The decline of linear television and the dominance of streaming services signify a fundamental shift in viewer preferences. The rise of CTV has further accelerated this transformation, allowing digital platforms to compete directly with traditional broadcasters in the living room.

For production companies, two viable strategies emerge: maintaining a focus on high-quality professional content within the existing television framework or diversifying into hybrid models that integrate elements of the creator economy. The latter approach is particularly relevant as user-generated content continues to capture audience engagement and advertising revenue.

Future industry success will likely depend on broadcasters’ ability to innovate their content delivery models, embrace digital-first strategies, and explore alternative funding mechanisms, such as brand partnerships and direct-to-consumer monetization. As digital disruption continues, traditional TV stakeholders must navigate an increasingly fragmented and competitive media environment to ensure long-term viability.

References

- Nielsen. (2023). The Gauge: Monthly TV Viewing Snapshot. Retrieved from https://www.nielsen.com/data-center/the-gauge/

- Ofcom. (2018). Media Nations: UK Report. Retrieved from https://www.ofcom.org.uk/media-use-and-attitudes/media-habits-adults/media-nations-2018/

- Ofcom. (2022). Media Nations Report 2022. Retrieved from https://www.ofcom.org.uk/siteassets/resources/documents/research-and-data/multi-sector/media-nations/2022/media-nations-2022-uk

- Ofcom. (2023). Understanding the UK’s TV Production Sector. Retrieved from https://www.ofcom.org.uk/siteassets/resources/documents/research-and-data/tv-radio-and-on-demand-research/tv-research/uk-tv-production-sector/understanding-uks-tv-production-sector.pdf

- Pact. (2024). Pact Census 2024. Retrieved from https://www.pact.co.uk/resource/pact-census-2024.html

- YouTube. (2024). YouTube Partner Program Revenue Data. Retrieved from https://www.youtube.com/partner-program