It’s almost insolent how thriving the sports media industry is with a 2.4% YoY growth of sports media rights value at 56B$ according to SportBusiness Global Media Report 2023.

2024 saw the NBA topping the 76B$ deal value (+165%) for their 2025-2036 rights cycle.

Every platform fighting for our daily attention wants a piece of the sports business. Not every one of them can afford it though. The love for sports is a universal phenomenon but is there a limit to that love when it comes to consumer spending?

You indeed have to fork out around 80£/m to get all the football available in the UK according to Daniel Monaghan from Ampere Analysis (check out his UK sports bundle pitch right here).

Sports Subscriptions: Glass Ceiling Coming Up?

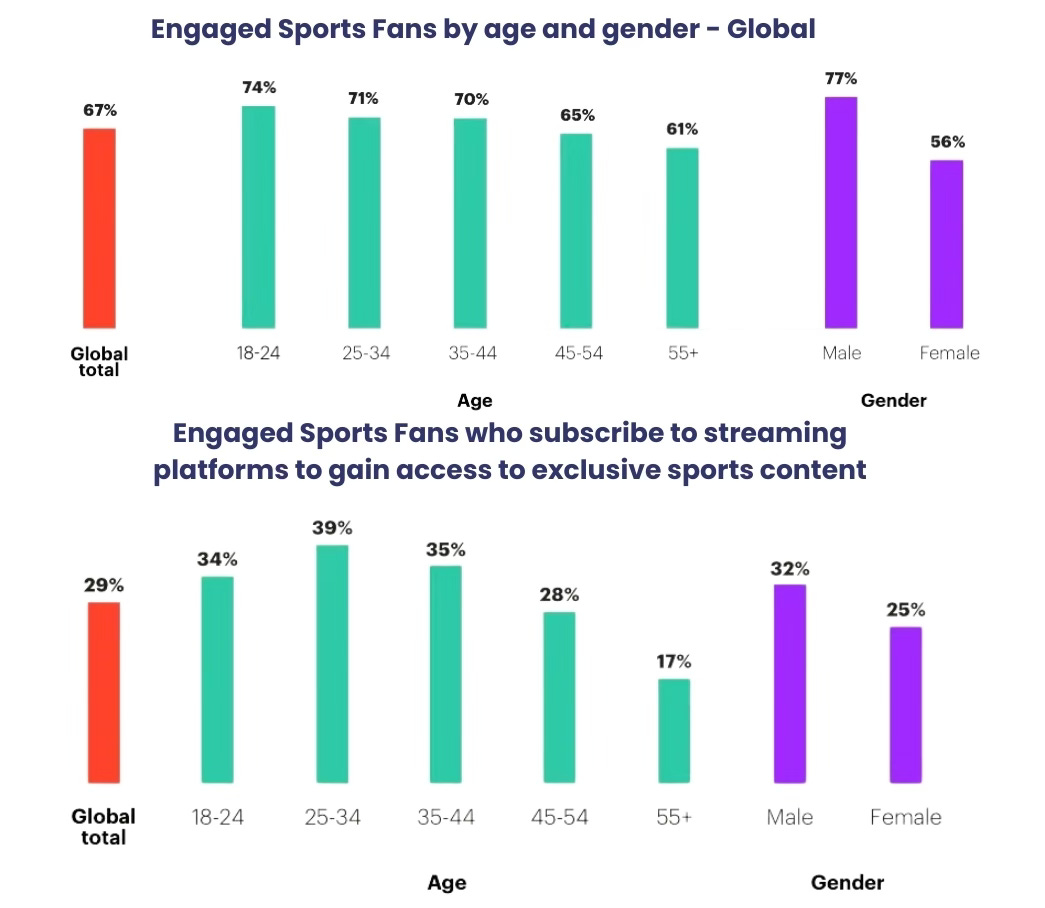

→ Over two thirds of global consumers (67%) follow sports on a regular basis (i.e. in the last 30 days) via various media platforms according to YouGov’s Global Sports Media Landscape report.

→ Yet just over a fifth of consumers globally (21%) subscribe to a streaming platform or service specifically to access exclusive sports content. The number goes up to 29% amongst the Engaged Sports Fans segment. According to Kantar, 1 in 5 new streaming subscribers are motivated to sign-up to see the sports they love.

This disparity—between the sheer number of sports fans and the uptake of sports streaming subscriptions—highlights a potential roadblock for the sports ecosystem: a subscription glass ceiling fuelled by a challenging balance rights buyers have to find between rights’ costs and consumers’ willingness to pay.

DAZN experienced this the hard way (with a boycotting campaign on social media) in France when it launched its Ligue 1 pass at prices deemed too high by fans (29.99€ with a 12-month commitment; 39.99€ without). Ensued several price promotions at 19.99€ / month, this week with Black Friday at 14.99€, to feed the sub acquisition engine. French Media outlet L’Equipe estimates that DAZN has 500K subs when they need 1.5M to be profitable.

Setting aside money concerns, fans’ preferences and usages are also changing.

Live Events: A Waning Appeal?

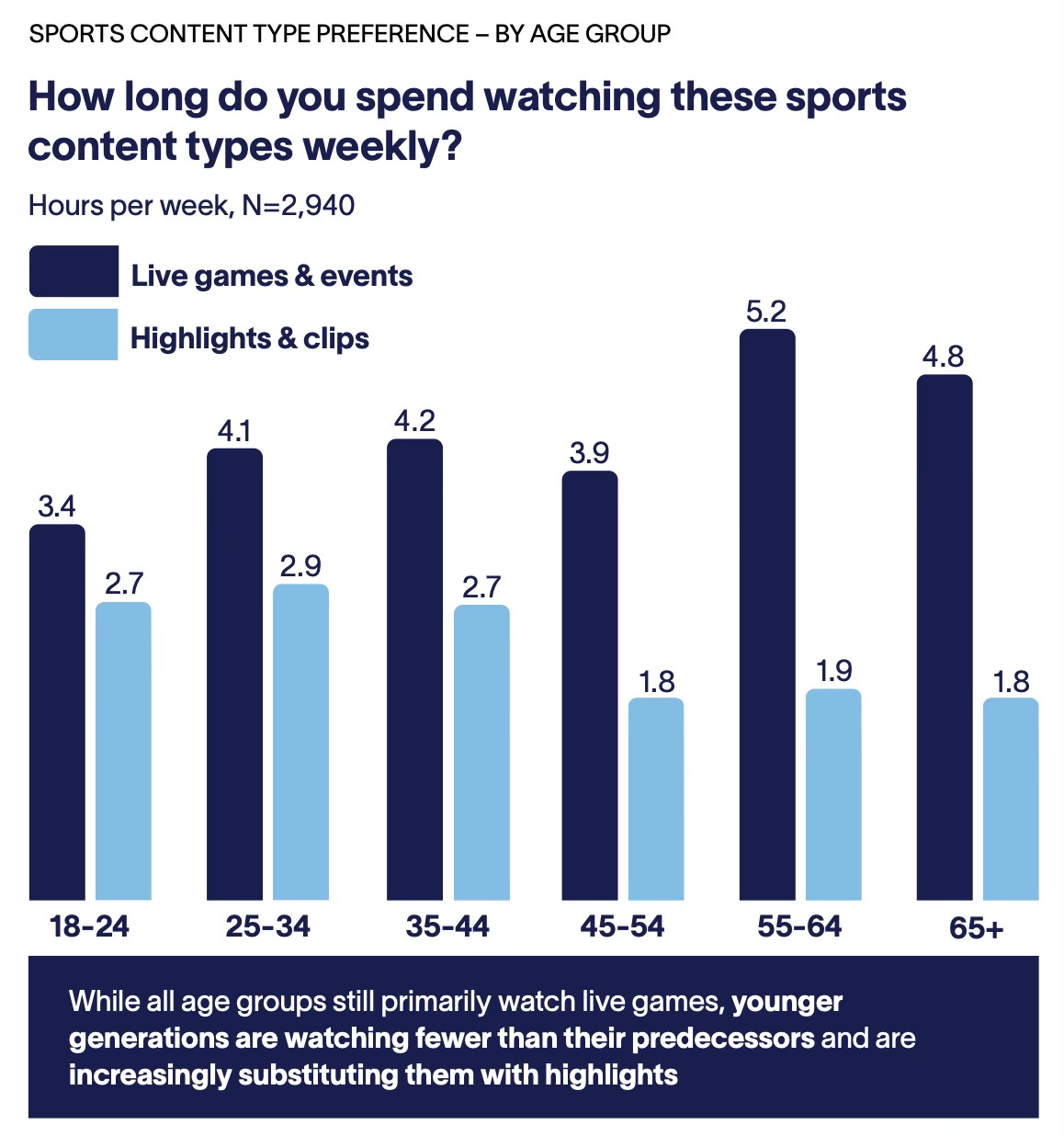

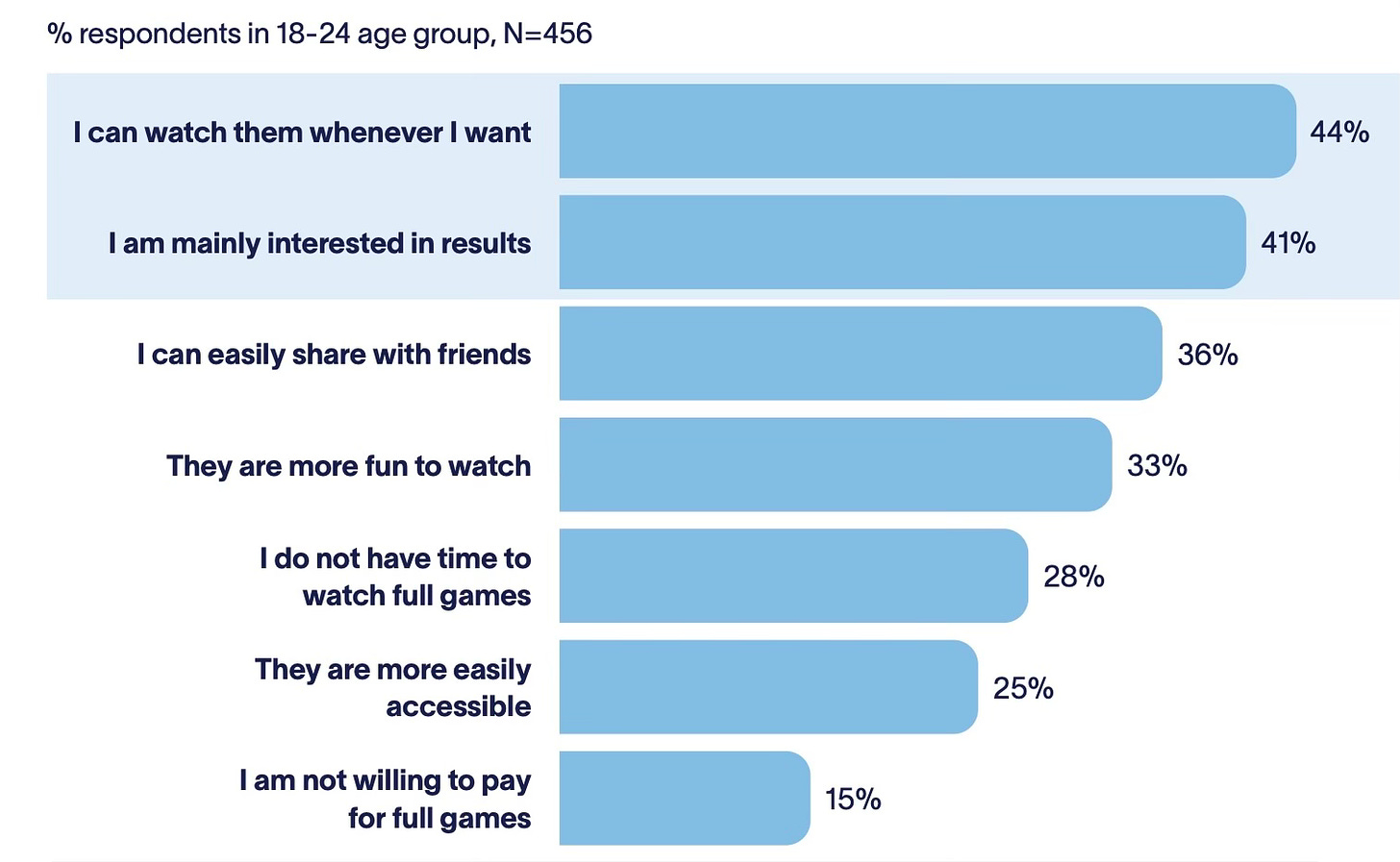

Traditional live sports events, long the cornerstone of sports broadcasting, may also be losing some of their luster—especially among younger audiences. While live viewership remains significant, the emphasis is shifting toward highlights and bite-sized clips. Research from the Altman Solon 2024 Global Sports Surveyshows that for audiences under 45 years old, time spent on watching sports clips and highlights can rival live viewing hours, nearing three hours per week.

Why this interest beyond live?

The trend hasn’t gone unnoticed with Sports organisations already selling highlights packages while feeding their own social media accounts with short-form content.

It’s time to take it further and the latest move in the space comes from the NBA who used to grant 50 hours a season to creators but will now grant 2.5K hoursper season with a 25K hours of back catalogue access.

Speaking of creators…

Who else is best positioned to grab that opportunity?

We’ve witnessed the rise of content creators who combine sports passion with entertainment. Sports-focused creators like:

→ YouTuber Celine Dept have reshaped how fans engage with their favourite sports. With over 39.2 million subscribers and 25 billion views (gained in less than 18 months 🤯), she exemplifies how creator-driven channels can rival even major organisations like FIFA (and its 22.2 million subscribers and 7 billion views on YouTube) in reach and impact.

https://www.youtube-nocookie.com/embed/0qYgq7XVxjU?rel=0&autoplay=0&showinfo=0&enablejsapi=0

→ YouTuber Jesser has 22.2M subscribers and garnered 5,79B views (with 1.4K videos). For comparison, the NBA has 22.4M subs and 14,6B views (with 40K videos).

https://www.youtube-nocookie.com/embed/-CpbCWBPWhc?rel=0&autoplay=0&showinfo=0&enablejsapi=0

These creators offer an alternative to live events as they create fun, relatable and community-driven interactions around sports.

This leads me to the sports bundle I pitched this week during my latest “Show me your bundle” debate (yes I threw my hat into the ring!).

Introducing: The Dude Perfect Sports Bundle

It’s no coincidence that the newly appointed CEO for Dude Perfect is Andrew Yaffe, a former NBA executive. These guys LOVE sports.

Dude Perfect by the numbers:

→ 60.6M YouTube subscribers

→ 1.45M paid subscribers to Dude Perfect+

→ 17.9B views on YouTube alone

→ A big check of 100M$ from Private Equity firm Highmount Capital.

A “Dude Perfect Sports Bundle” would offer a mix of sports verticals, including basketball, golf, and outdoor sports etc., paired with innovative formats (like they do today chat shows, challenges), bespoke live events (they’re going on a “world” tour in the US and the UK), watch parties, games, behind-the-scenes footage, and community-driven interactions.

Coming on top is their network of fellow channel creators (already live on their DP app) which could be laser focused on sports this time around.

Thematic Analysis

This article discusses several key themes in the evolving landscape of sports media consumption and rights valuation. Here’s a thematic analysis with supporting scientific sources:

Global Growth in Sports Media Rights

The article highlights the significant growth in sports media rights, citing a 2.4% year-over-year increase to $56 billion. This trend is supported by academic research:

Smith, P., Evens, T., & Iosifidis, P. (2015). The regulation of television sports broadcasting: A comparative analysis. Media, Culture & Society, 37(5), 720-736. https://doi.org/10.1177/0163443715577244

This study examines the increasing value of sports broadcasting rights and its impact on media regulation.

Changing Consumption Patterns

The article notes a shift in viewer preferences, especially among younger audiences, towards highlights and short-form content over traditional live broadcasts. This trend is corroborated by recent research:

Hutchins, B., Li, B., & Rowe, D. (2019). Over-the-top sport: Live streaming services, changing coverage rights markets and the growth of media sport portals. Media, Culture & Society, 41(7), 975-994. https://doi.org/10.1177/0163443719857623

This study explores the rise of streaming services and changing viewer habits in sports media consumption.

Subscription Saturation and Willingness to Pay

The article suggests a potential “subscription glass ceiling” due to the disparity between sports fans and those willing to pay for exclusive content. This concept is explored in:

Budzinski, O., Gaenssle, S., & Kunz-Kaltenhäuser, P. (2019). How does online streaming affect antitrust remedies to centralized marketing? The case of European football broadcasting rights. International Journal of Sport Finance, 14(3), 147-157.

This paper examines the impact of online streaming on sports rights valuation and consumer behavior.

Rise of Content Creators in Sports Media

The article emphasizes the growing influence of content creators in sports media. This trend is analyzed in:

Pegoraro, A. (2010). Look who’s talking—Athletes on Twitter: A case study. International Journal of Sport Communication, 3(4), 501-514. https://doi.org/10.1123/ijsc.3.4.501

While this study focuses on athletes’ use of social media, it provides insights into the changing landscape of sports content creation and distribution.

Innovative Content Formats

The article discusses new content formats, such as those offered by Dude Perfect. This aligns with research on sports media innovation:Hutchins, B., & Rowe, D. (2012). Sport beyond television: The internet, digital media and the rise of networked media sport. Routledge.

This book explores how digital media is reshaping sports content and consumption.

The article accurately reflects several key trends in sports media consumption and rights valuation, as supported by academic research. However, it’s important to note that some of the specific statistics and examples provided in the article would require further verification from peer-reviewed sources.

Suggestions for Research

Here are ten research suggestions for second-year media students focusing on the European/Dutch sports media market:

- The impact of streaming platforms on traditional sports broadcasting in the Netherlands.

- Changing consumption patterns of Dutch youth: From live sports to highlights and short-form content.

- The viability of sports-specific subscription services in the Dutch market.

- Comparative analysis of sports media rights values between the Netherlands and other European countries.

- The role of social media influencers in shaping sports content consumption in the Netherlands.

- Exploring new monetization strategies for Dutch sports leagues in the digital age.

- The potential of esports in the Dutch sports media landscape.

- Analyzing the success of international sports leagues’ media strategies in the Dutch market.

- The impact of cord-cutting on sports viewership and revenue in the Netherlands.

- Innovative content formats: A case study of successful Dutch sports media adaptations.

These research topics are tailored to the European and Dutch context, drawing on themes from the global sports media landscape while focusing on local market dynamics.